The Strategic Shift to Accounts Payable Outsourcing in Mid-Sized Firms

As mid-sized businesses grow and scale, one area that often becomes a bottleneck is the back office — particularly the accounts payable (AP) process. Managing invoices, approvals, and vendor payments internally can quickly become overwhelming, especially when volume increases but the internal team size stays the same.

To address these challenges, a growing number of mid-sized firms are making a strategic shift to accounts payable outsourcing. What was once seen as a solution only for large enterprises is now proving to be a scalable, cost-effective, and intelligent move for companies looking to streamline operations and focus on growth.

Let’s explore why mid-sized businesses are embracing AP outsourcing, what benefits it offers, and how to make the transition successfully.

Why Mid-Sized Firms Are Rethinking In-House AP

Traditionally, mid-sized companies have managed AP internally, with small teams juggling multiple roles. But as the business grows, this approach presents serious challenges:

-

Manual data entry leads to errors and inefficiencies

-

Late payments damage vendor relationships and result in penalties

-

Inconsistent processes make it harder to track and audit payments

-

Limited resources slow down approval cycles and month-end closings

-

Growing compliance risks create stress and potential liabilities

These pain points are pushing finance leaders to seek smarter alternatives — and outsourcing AP has emerged as one of the most effective solutions.

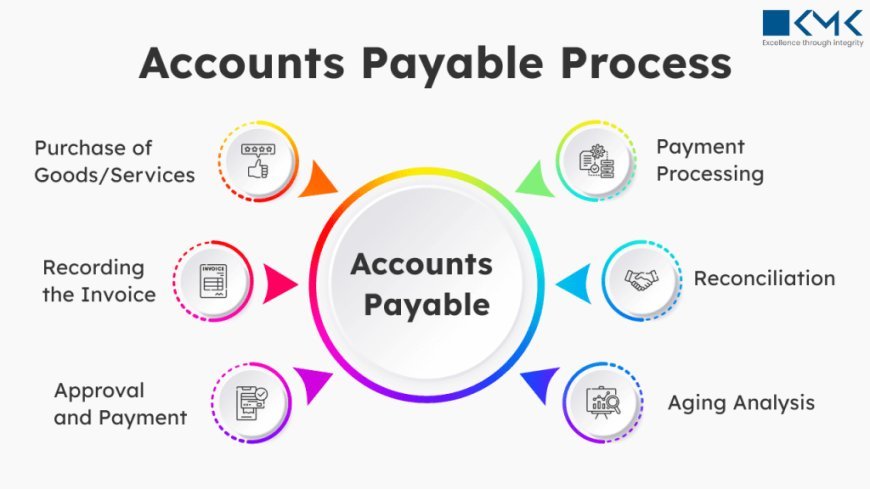

What Is Accounts Payable Outsourcing?

Accounts payable outsourcing involves partnering with a third-party service provider to handle all or part of the AP function. This includes tasks like:

-

Invoice data capture and validation

-

Purchase order matching

-

Approval workflow management

-

Payment processing

-

Vendor communication

-

Reporting and analytics

The provider typically uses cloud-based AP automation tools, enabling mid-sized firms to enjoy enterprise-level efficiency without heavy upfront investment.

Key Benefits for Mid-Sized Businesses

1. Operational Efficiency

Outsourcing AP allows businesses to eliminate repetitive tasks, reduce paperwork, and automate the invoice lifecycle. With advanced tools and trained professionals, outsourcing partners can process invoices faster and more accurately than in-house teams.

This leads to:

-

Quicker approvals

-

Fewer errors

-

More consistent processes

Ultimately, your AP department becomes leaner, faster, and more reliable.

2. Scalability Without Hiring

Mid-sized firms often face a dilemma: growing invoice volumes but limited budget to expand the finance team. With AP outsourcing, you don’t have to hire or train new staff — the provider scales the service as your needs grow.

This flexible model supports business growth while keeping overhead costs predictable and low.

3. Cost Savings

Outsourcing can significantly reduce the total cost of AP operations by:

-

Lowering headcount requirements

-

Reducing processing errors and penalties

-

Minimizing software and infrastructure investments

On average, businesses save up to 40–50% in processing costs when they switch from manual, in-house AP to an automated outsourced solution.

4. Improved Compliance and Audit Readiness

Mid-sized companies often struggle with maintaining consistent documentation and audit trails. Outsourced AP partners follow industry best practices and regulatory standards, providing secure storage, access control, and detailed audit logs.

This ensures you're always ready for audits and regulatory reviews — without scrambling for missing invoices.

5. Enhanced Cash Flow Visibility

Modern AP outsourcing services come with real-time dashboards and reports. These tools give finance leaders greater visibility into:

-

Pending payments

-

Payment schedules

-

Vendor spending

-

Early payment discounts

With better data at your fingertips, you can optimize cash flow and strengthen vendor relationships.

Common Myths That Hold Firms Back

Despite the advantages, some mid-sized firms hesitate to outsource due to common misconceptions:

-

“We’ll lose control.” In reality, outsourced AP provides more visibility and control through dashboards and alerts.

-

“It’s only for large companies.” Providers now tailor solutions specifically for mid-sized firms with flexible pricing and modular services.

-

“Transitioning will be complicated.” Most outsourcing partners offer onboarding support, systems integration, and training for a smooth transition.

Once these myths are cleared, businesses often realize that outsourcing is easier and more effective than expected.

How to Make the Shift Smoothly

If you’re considering outsourcing your AP, here’s how to approach it strategically:

✅ 1. Assess Your Current Process

Identify inefficiencies, bottlenecks, and costs in your current AP setup. This will help you set clear goals for outsourcing.

✅ 2. Choose the Right Partner

Look for a provider that specializes in working with mid-sized businesses and offers:

-

Cloud-based solutions

-

Strong security protocols

-

Industry-specific experience

-

Transparent pricing and SLAs

✅ 3. Ensure Systems Integration

The provider should integrate seamlessly with your existing ERP or accounting platform (e.g., QuickBooks, NetSuite, SAP).

✅ 4. Set KPIs and Expectations

Define performance metrics such as turnaround time, accuracy rate, and cost savings. Regular reporting ensures alignment and accountability.

✅ 5. Train Your Internal Team

Even with outsourcing, internal stakeholders must know how to access reports, approve invoices, and collaborate with the AP provider.

Final Thoughts

The strategic shift to accounts payable outsourcing is no longer just a trend — it’s a smart business decision for mid-sized firms that want to grow without growing internal complexity.

By handing over routine, time-consuming AP tasks to a trusted partner, your finance team can focus on what really matters: driving insights, managing cash flow, and contributing to strategic decisions.

If you’re ready to make your back-office smarter, faster, and more cost-effective, outsourcing accounts payable may be the strategic edge your company needs in 2025.

What's Your Reaction?