PPF Calculator: How to Predict the Growth of Your Investment Over Time

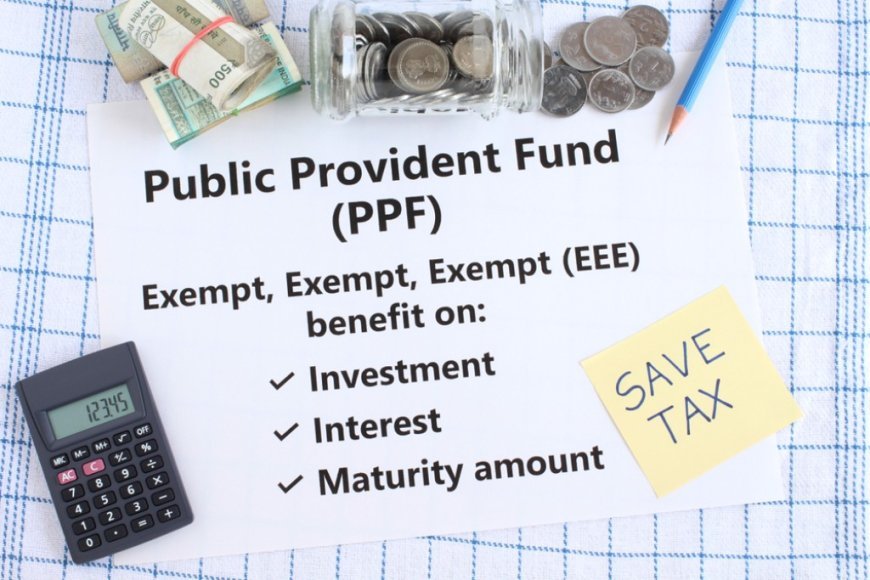

The Public Provident Fund (PPF) is one of the most popular investment instruments in India, well-regarded for its attractive returns and tax benefits. Designed to encourage long-term savings, PPF is a government-backed, risk-free investment avenue with a lock-in period of 15 years. Understanding how your PPF investment can grow over time is crucial for effective financial planning. This is where a PPF calculator becomes an invaluable tool. By using a PPF calculator, investors can easily predict their investment growth over different time horizons without engaging in complex calculations.

What is PPF?

Before delving into the utility of a PPF calculator, it’s essential to understand what PPF is. The Public Provident Fund scheme was introduced by the Indian government in 1968 to mobilize small savings in the form of an investment with reasonable returns coupled with income tax benefits. A PPF account can be opened with a minimum deposit of INR 500 and can go up to INR 1.5 lakh per fiscal year. The scheme offers an interest rate that the government declares quarterly, making it a risk-free long-term investment.

The Mechanics of a PPF Calculator

A PPF calculator is a digital tool that helps investors to estimate the maturity amount of their PPF investment over a specified time. It essentially calculates the compounded annual returns by considering several variables, including the annual investment, tenure, and the prevailing interest rate. By simply entering these parameters, one can quickly gauge how much their investment will grow by the end of the tenure.

Here’s a simplified formula used in PPF calculations:

\[ A = P \left(1+\frac{r}{100}\right)^n \]

Where:

- \( A \) is the maturity amount.

- \( P \) is the annual investment.

- \( r \) is the annual interest rate.

- \( n \) is the number of years.

Let's assume an annual investment of INR 1.5 lakh, a prevailing interest rate of 7.1%, and a tenure of 15 years. Plugging these into the formula:

\[ A = 150000 \left(1+\frac{7.1}{100}\right)^{15} \]

This will yield a maturity amount of approximately INR 40.68 lakh at the end of the 15-year tenure, showcasing the power of compound interest over time.

Advantages of Using a PPF Calculator

1. Time-saving and Accurate: Using a PPF calculator allows for quick and accurate projections of investment growth, saving time and reducing the chances of human error in manual calculations.

2. Future Planning: By forecasting returns, investors can align their financial goals with expected PPF growth, allowing for better planning in areas like retirement, education, or any long-term financial commitment.

3. Adjustability: Many calculators allow adjustments for contributions or rates of return, providing a more holistic view by simulating various investment scenarios.

4. No Cost Involved: Most PPF calculators are available for free online and are exceedingly user-friendly, requiring no technical expertise.

How to Use a PPF Calculator

Using a PPF calculator is straightforward:

1. Input the Principal Investment: Enter the amount you wish to deposit annually in your PPF account.

2. Enter the Interest Rate: Input the applicable interest rate. Ensure it is adjusted for any quarterly or annual changes declared by the government.

3. Tenure of Investment: Input the number of years you plan to keep the investment, traditionally 15 years for PPF accounts.

4. Calculate: Press the calculate button to get your estimated maturity amount.

Things to Consider

-

The PPF interest rate is not fixed and is subject to change every quarter based on government notification.

-

Premature closure and withdrawals are restricted and generally not encouraged.

-

Extending the tenure beyond 15 years is possible in blocks of 5 years without any cap on the number of extensions.

Summary

A PPF calculator serves as a practical tool for predicting the growth of your investment in the Public Provident Fund over time. It empowers investors by offering quick and precise calculations based on annual contributions, prevailing interest rates, and the investment tenure. Understanding what is PPF—a government-backed savings scheme aimed at long-term investments—frames its appeal as a risk-free and tax-efficient option. By entering simple parameters, investors can strategize for future financial goals, ensuring that their savings align with their aspirations. Despite its many benefits, potential investors must consider any interest rate changes and bear in mind possible restrictions concerning withdrawals before investing in a PPF. Thus, it's advisable to fully understand the intricacies of the Indian financial market before making commitments.

Disclaimer

The use of PPF calculators provides an estimate of possible returns, which are subject to the current interest rate and financial climate. Though the Public Provident Fund is a secure investment avenue, it’s essential for investors to evaluate all factors, including interest rate fluctuations and financial market conditions in India, before proceeding with their investment strategies.

What's Your Reaction?