Top Benefits of Joining a Chit Fund – Why Millions of Indians Trust It

In India, financial planning isn’t just about banks, loans, and stock markets. For generations, people have trusted a simple, community-based saving method called the Chit Fund. From small towns to bustling cities, chit funds continue to play a powerful role in helping millions of Indians meet their financial goals—whether it’s starting a small business, planning a wedding, or handling an emergency.

But what makes chit funds so reliable and popular even in today’s digital age?

Let’s dive into the top benefits of joining a chit fund and why it might be the smart choice you’re looking for.

1. Easy Savings, Flexible Payouts

A chit fund is a great mix of saving and borrowing. Every member contributes a fixed amount each month. One member gets access to the entire pot of money every cycle through a simple bidding process. This continues until every member has received their share.

This unique model allows you to save regularly while having the flexibility to access a lump sum when you need it most.

Whether you're planning a home renovation or need money for school fees, chit funds give you access to funds without the complications of traditional loans.

2. No Collateral Needed

One of the biggest benefits of a chit fund is that you don’t need to provide any security or collateral. Unlike banks that demand documents, guarantors, or assets to approve loans, chit funds work on mutual trust within the group.

This makes chit funds a lifesaver for small business owners, homemakers, freelancers, and those who might not have easy access to formal credit systems.

3. Quick and Hassle-Free Access to Money

Let’s face it—emergencies don’t knock before they enter. Be it a medical expense, a job loss, or a sudden opportunity, sometimes you need money fast.

Chit funds give you the chance to access your funds without delay, especially if you win the bid early in the cycle. No long paperwork, no waiting for approvals. You can get what you need, when you need it.

Platforms like My Paisaa make this even simpler. With just a few taps on your phone, you can join a chit, track your savings, and request withdrawals in minutes.

4. Better Than Loans (In Many Cases)

Bank loans come with interest, strict repayment schedules, and credit checks. Chit funds offer a friendlier alternative.

In a chit fund, the “interest” you pay or earn depends on your bidding strategy. If you take the fund early, you accept a lower payout (which benefits the group). If you wait longer, you receive more money. It’s a give-and-take model that works for everyone.

Plus, in digital chit platforms like My Paisaa, you can view transparent bidding, real-time chit balance, and user-friendly dashboards. No hidden fees. No stress.

5. A Trusted System with Deep Roots

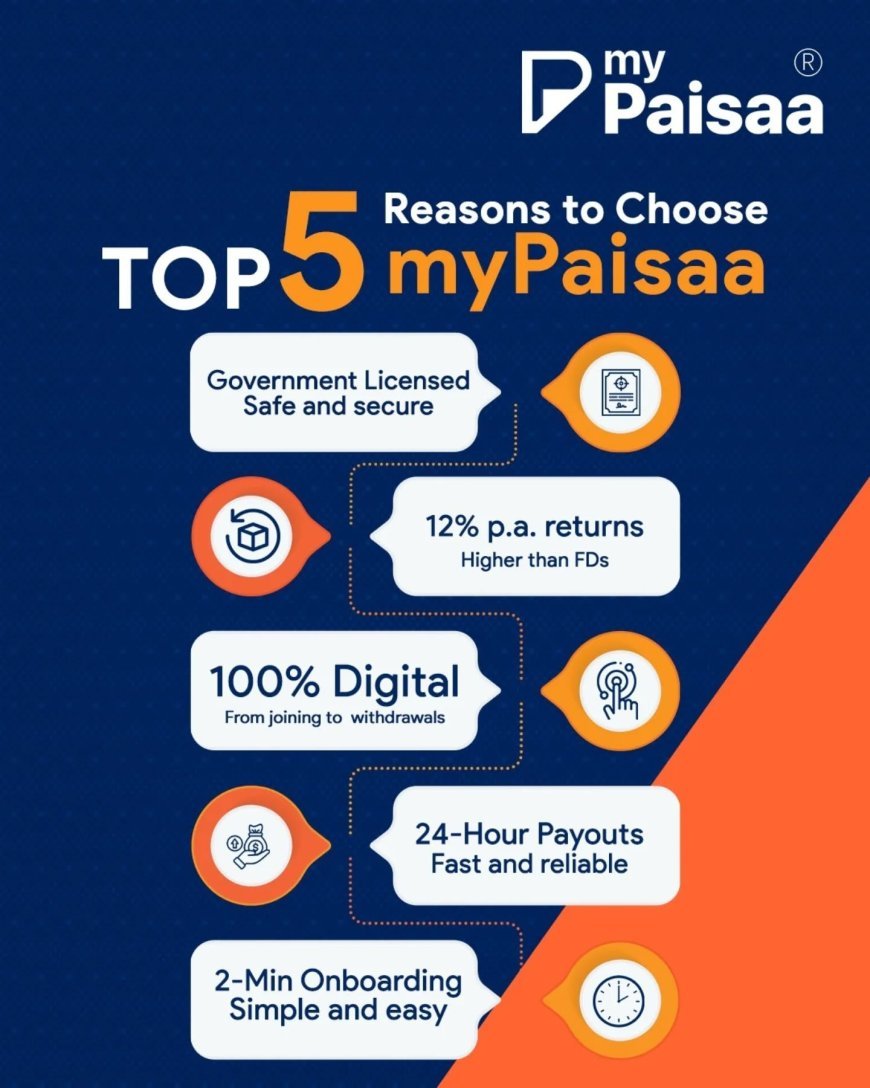

Chit funds aren’t a new idea. They've been around for centuries and are regulated by the government under the Chit Funds Act, 1982. Many families have relied on chit funds for generations to buy land, invest in gold, or build businesses.

This long-standing tradition creates a sense of community trust. You're not dealing with unknown lenders or complex financial products—you’re saving and borrowing with fellow members, just like you.

And with registered platforms like My Paisaa, your money is safe, transparent, and managed by experts who follow all regulatory norms.

6. Perfect for Goal-Based Saving

Planning a wedding? Saving for your child’s education? Want to travel abroad?

A chit fund can help you stay disciplined with your savings while giving you access to a larger sum when your goal is near. It’s like a goal-based savings plan—but with more flexibility and real community support.

Set your goal, choose a chit plan that suits your monthly budget, and stay on track. With digital apps like My Paisaa, you even get reminders and automated payments to make saving effortless.

7. Accessible to Everyone

One of the most beautiful aspects of chit funds is that anyone can join—regardless of age, job, income level, or financial background. Whether you earn a fixed salary, run a local shop, or work as a freelancer, chit funds welcome everyone.

Especially now, with digital chit apps like My Paisaa, you can join from anywhere in India. No need to visit an office or attend in-person meetings. Just download the app, complete your KYC, and start your journey.

Take the First Step Today with My Paisaa

Still wondering if a chit fund is right for you? Here’s the truth—millions of Indians trust chit funds because they work. They’re simple, transparent, and built for people like you.

And thanks to modern, user-friendly apps like My Paisaa, you can now enjoy the trust of traditional chit funds with the convenience of digital technology. Track your savings, participate in auctions, and receive funds—all from your phone.

Download the My Paisaa app today and take control of your financial future. Whether you're saving for a big dream or need funds for an unexpected turn in life, a chit fund might just be the smart, reliable choice you’ve been looking for.

Final Thoughts

Chit funds are not just about money. They’re about trust, discipline, and community. They help you stay on track with your savings, offer support when you need cash, and create opportunities to grow—financially and personally.

With platforms like My Paisaa, joining a chit fund is now easier than ever.

So why wait? Take action today. Start your journey with a chit fund—and make your money work smarter, not harder.

What's Your Reaction?