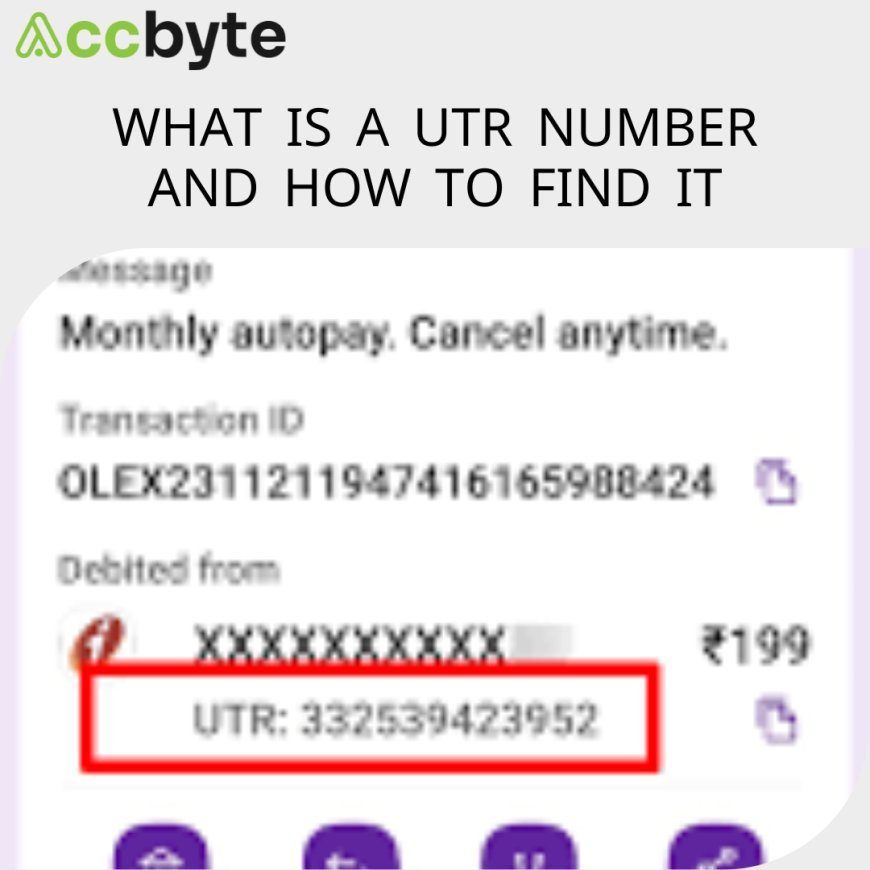

What is a UTR Number and How to Find It

Every taxpayer, whether they are an individual taxpayer or a corporate, needs their Unique Tax Reference Number in the UK that is issued by HMRC. It is required at the time of filing your tax returns. But what is it and where it can be found is the bigger question.

Well, worry not. In this post, we have got you covered, what is a UTR number and how to find utr number.

So, let’s break down the core concept of UTR number.

What is a UTR Number

The Unique Tax Reference Number is a 10-digit tax identification number issued by HMRC to recognise the individual or corporations. It is required when you wish to accomplish your self-assessment tax returns. In other words, it is a unique identification number which is a way to identify your taxing accounts and match your payment with the due bills. Once you register for a Self Assessment tax return on HMRC, they generate a UTR number which depends on your business status. The UTR number varies depending on whether you are an individual tax payer or a corporate.

The UTR number is also issued to the self-employed and landlords, and they need it at the time of submission of tax returns, to pay their tax bills or when hiring an accountant for that purpose.

But the biggest query is how to find out utr number. Well, proceed with us.

When do Businesses Need a UTR Number

Any individual or businessman who wishes to file their Self Assessment tax return, requires a UTR number generated by HMRC. It is required in certain instances

-

When you need to update your details on HMRC.

-

Entering a query

-

At the time when you need to submit your Self Assessment tax returns

This is very essential to keep your business complaint with all UK obligations and avoid penalties. When you hire an accountant to perform your taxation processing, you will need

that Unique Tax Reference number to proceed.

How to Get your UTR Number

If you are a business owner or an individual, you need to register on the HMRC portal to get your unique UTR number. To register on self-assessment, you need to enter your personal details on the required fields. Here is how to find your utr number,

-

Open any browser and go to HMRC portal to register for self assessment and 2nd class national insurance.

-

Here, you need to enter your user ID and password, if you are the first-time user create your User ID and password. if you have already registered, proceed with your login credentials to access the tax account.

-

Once you have logged in you will need to enter your personal details like your name, date of birth, address, email address, and phone number. If you are a business owner, you need to enter information about your business, such as the nature of your business and the date of beginning.

-

After that, “Submit” your details, your UTR number will be sent to your email.

- The Unique Tax Reference Number is a 10-digit tax identification number issued by HMRC to recognise the individual or corporations. It is required when you wish to accomplish your self-assessment tax returns. In other words, it is a unique identification number which is a way to identify your taxing accounts and match your payment with the due bills. Once you register for a Self Assessment tax return on HMRC, they generate a UTR number which depends on your business status. The UTR number varies depending on whether you are an individual tax payer or a corporate.The Unique Tax Reference Number is a 10-digit tax identification number issued by HMRC to recognise the individual or corporations. It is required when you wish to accomplish your self-assessment tax returns. In other words, it is a unique identification number which is a way to identify your taxing accounts and match your payment with the due bills. Once you register for a Self Assessment tax return on HMRC, they generate a UTR number which depends on your business status. The UTR number varies depending on whether you are an individual tax payer or a corporate.The Unique Tax Reference Number is a 10-digit tax identification number issued by HMRC to recognise the individual or corporations. It is required when you wish to accomplish your self-assessment tax returns. In other words, it is a unique identification number which is a way to identify your taxing accounts and match your payment with the due bills. Once you register for a Self Assessment tax return on HMRC, they generate a UTR number which depends on your business status. The UTR number varies depending on whether you are an individual tax payer or a corporate.The Unique Tax Reference Number is a 10-digit tax identification number issued by HMRC to recognise the individual or corporations. It is required when you wish to accomplish your self-assessment tax returns. In other words, it is a unique identification number which is a way to identify your taxing accounts and match your payment with the due bills. Once you register for a Self Assessment tax return on HMRC, they generate a UTR number which depends on your business status. The UTR number varies depending on whether you are an individual tax payer or a corporate.The Unique Tax Reference Number is a 10-digit tax identification number issued by HMRC to recognise the individual or corporations. It is required when you wish to accomplish your self-assessment tax returns. In other words, it is a unique identification number which is a way to identify your taxing accounts and match your payment with the due bills. Once you register for a Self Assessment tax return on HMRC, they generate a UTR number which depends on your business status. The UTR number varies depending on whether you are an individual tax payer or a corporate.The Unique Tax Reference Number is a 10-digit tax identification number issued by HMRC to recognise the individual or corporations. It is required when you wish to accomplish your self-assessment tax returns. In other words, it is a unique identification number which is a way to identify your taxing accounts and match your payment with the due bills. Once you register for a Self Assessment tax return on HMRC, they generate a UTR number which depends on your business status. The UTR number varies depending on whether you are an individual tax payer or a corporate.The Unique Tax Reference Number is a 10-digit tax identification number issued by HMRC to recognise the individual or corporations. It is required when you wish to accomplish your self-assessment tax returns. In other words, it is a unique identification number which is a way to identify your taxing accounts and match your payment with the due bills. Once you register for a Self Assessment tax return on HMRC, they generate a UTR number which depends on your business status. The UTR number varies depending on whether you are an individual tax payer or a corporate.

Also, you can send a request letter to get your UTR number.

What's Your Reaction?